What Is Cif Number in Sbi Bank Passbook

The moment should ring familiar to most of us. You need access to your bank account for one reason or another and it needs you to provide your bank routing number. Too long for you to memorize, too infrequently needed for you to always keep on you, the string of digits remains a practice as frustrating as it is persistent in the banking industry. But what exactly is it, what can you do with it, and most importantly, where can you find it?

What Is a Bank Routing Number?

The routing number itself is a string of nine numbers. The first four are Federal Reserve identifiers, with digits 1 and 2 indicating which of the 12 Federal Reserve Banks the check originated from and the next two indicating whichever Federal Reserve check processing center has been assigned to your bank. Today, though, all processing has been assigned to the Atlanta Federal Reserve bank.

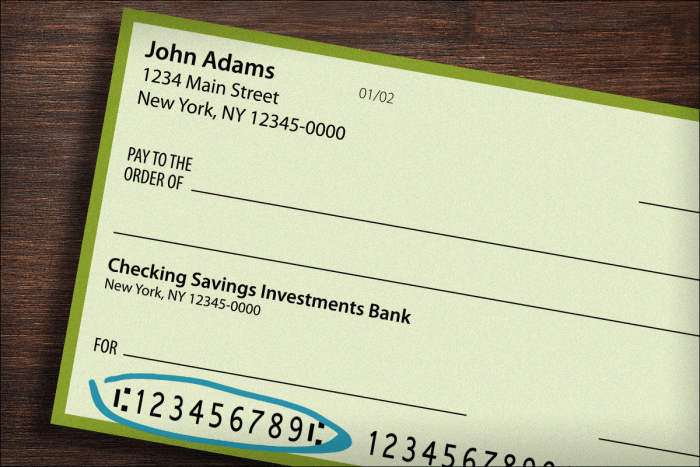

Routing numbers on a check.

TheStreet

The next four numbers represent the specific ABA code of your bank, remaining completely unique to your particular branch.

The ninth, final digit provides a number for a checksum. In other words, it is tested in an equation with all the other digits to verify that the routing number is valid.

The routing number, in total, determines the Federal Reserve district and intended processing center for your check, what bank it originates from, and whether it's a valid financial instrument.

The importance of this number stems from the fact that check processing systems can use it to accept, reject, and sort checks. This eliminates the need for human labor in this system and, through that, allows for the processing of massive amounts of checks.

Where Did Routing Numbers Come From?

The ABA routing transit number dates back to 1911, when the American Bankers Association, in the midst of a disagreement on how to identify checks, settled on instituting the ABA routing number system following a conference in Chicago.

For context, this was a time when 30,000 different banks operated in the U.S., with no clear consolidation of the market like it is today, where 10 of the 18,000 banks in operation hold over 50% of deposits.

With so many different banks out there, the routing number played a key role in avoiding confusions like checks originating from U.S. Bank being withdrawn from Bank of the United States.

TheStreet Recommends

When Is a Routing Number Used?

A routing number can come up in many situations. Prime examples include when making payments over the phone or online or making automatic bill payments. In these instances, you'll usually be asked for both your routing number and account number.

Additionally, if you want to process checks or transfer money internationally, you'll have to provide your routing number so the bank can know where to allocate your funds.

How to Find a Routing Number

There's a couple of different ways to find your routing number.

For one, you can find it on a check issued from the bank you're trying to use. It'll typically be on the lower left hand corner of the check. Just look for a string of nine digits. To the right of it you should see your account number and the actual check number.

If checks aren't around, you can also log onto your online banking account, where your routing number will likely be listed somewhere with your account information. When going online isn't an option, calling your bank can also get you your account number.

Another way is finding it on a bank's website. Routing numbers aren't sensitive private information like account numbers are, so check the website - sometimes under contact information or on the site's footer, or do a Google search for the local branch's routing number.

If all else fails, you can look up your routing number on ABA's website. Just input your bank and location for the site to find it.

Do Routing Numbers Change?

Yes, routing numbers do change. This usually happens when banks merge, consolidate, or acquire other banks.

While reconfiguring your regular payments with this new info could seem like a headache, banks thankfully offer ample time and instructions for their clients to adjust after a change in routing number. Typically, the old routing number will remain usable for months or even years after a change, and you'll be allowed to use checks with the old number until they run out. If they provide a deadline to stop using old checks, you can always just pick up a free box of new ones. While these trends tend to hold, remember to look at and follow the instructions your bank provides if any change in routing number occurs.

You should also review your bank transactions to find any recurring automatic transactions. If they continue to use the same routing number, you run the risk of your bank eventually no longer honoring the transaction. Reconfiguring these should be your priority in the event of a changed routing number.

Introducing TheStreet Courses: Financial titans Jim Cramer and Robert Powell are bringing their market savvy and investing strategies to you. Learn how to create tax-efficient income, avoid mistakes, reduce risk and more. With our courses, you will have the tools and knowledge needed to achieve your financial goals. Learn more about TheStreet Courses on investing and personal finance here.

What Is Cif Number in Sbi Bank Passbook

Source: https://www.thestreet.com/personal-finance/what-is-a-bank-routing-number-15031340

0 Response to "What Is Cif Number in Sbi Bank Passbook"

Post a Comment